The PFRDA also plans to launch a guaranteed return program in September this year. The regulator has appointed a group of actuaries, who are part of the Pensions Advisory Committee, to work with an outside consultant to finalize the scheme.

Supratim Bandyopadhyay, chairman of the PFRDA, told media in Mumbai that after meeting with institutions that pay out pensions, the regulator has received feedback that the number of subscribers will more than double, with most of them not organized sector. He said active subscribers grew from 22.7 million in March 2021 to 36.9 million in March 2022 and are expected to surpass 55 million by March 2023.

“Our aim is to increase the number of non-government subscribers as we see government employees as a captive base for NPS,” Bandyopadhyay said. He said a number of initiatives have been taken to make onboarding easier. This includes using a digital platform using Aadhaar & Digilocker and using cKYC & OTP based authentication.

The NPS is much more flexible than when it was first introduced. Subscribers can withdraw 60% of the amount and invest only 40% of the corpus in annuities. Pension purchases can also be deferred for up to 75 years. Subscribers can keep their bodies in NPS until age 75 and withdraw their savings annually as in a systemic payout schedule.

Low value subscribers do not need to purchase annuity and can withdraw their entire holding at maturity if the holding is less than Rs 5 lakh.

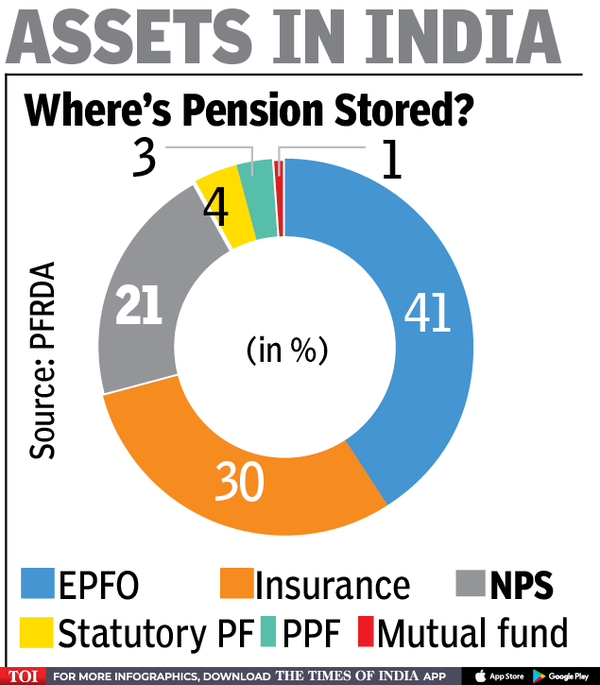

“The depth and maturity of the fixed income segment is reflected in the ratio of total fixed income to GDP. In India the total pension funds are around Rs 35 billion which is 14-15% of GDP while in most developed countries it is more than 100% of GDP showing that we still have a long way to go” he said Bandyopadhyay.