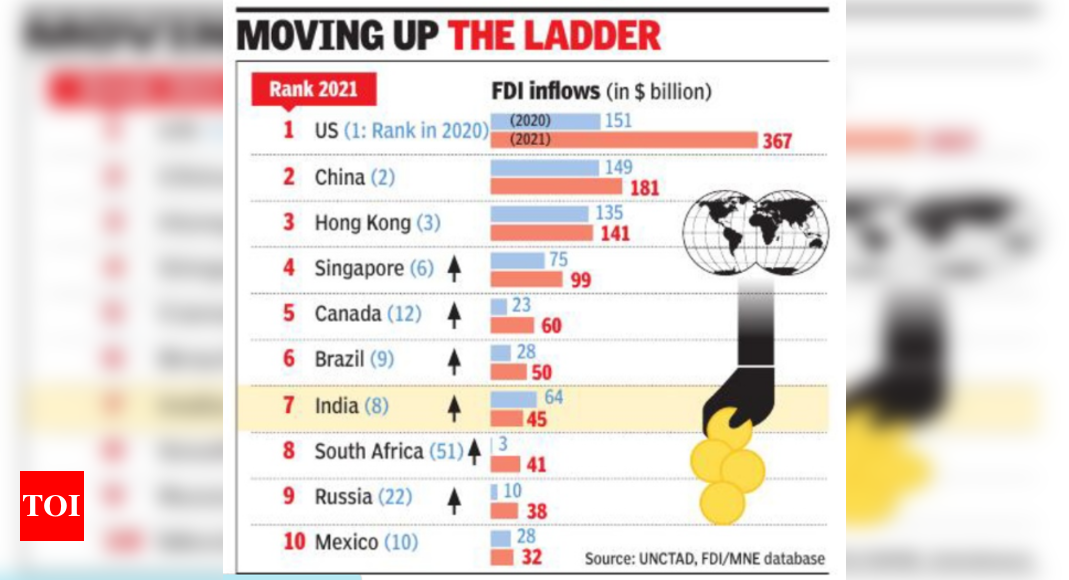

In 2021, FDI inflows to India were estimated at US$45 billion as major mergers and acquisitions, particularly in digital technology, were not repeated in 2021. Last year, companies like Reliance Jio received big investments from Facebook and Alphabet. However, India remains the preferred destination for digital MNCs looking to invest outside of the developed world as the country corners 7% of deals due to the “thriving tech startup scene”.

But Unctad was also optimistic about the general investment situation in the country. “…a spate of new international project financing has been announced in the country: 108 projects, compared to an average of 20 projects over the past 10 years. The largest number of projects (23) have been in renewable energy. Major projects include the construction in India of a steel and US$13.5 billion cement plant by ArcelorMittal Nippon Steel (Japan) and construction of a new automobile plant by Suzuki Motor (Japan) for US$2.4 billion.

It also said that nearly half of the R&D-related investment flowing into developing countries went to India, although 60% of that investment was cornered by developed countries. While India’s FDI inflows in 2021 were the lowest since 2018, outflows surged 43% to around $16 billion, the report said.

“Incurable gamer. Infuriatingly humble coffee specialist. Professional music advocate.”