With the shift to faceless assessments over the past two or more years, taxpayers face practical difficulties in obtaining the orders that give effect to appeal orders, which in turn affects their ability to receive any refunds that may be assessed. (Representative image via Unsplash)

The Treasury has indicated that India is on track to meet the fiscal deficit target of 6.4% of GDP for FY 2022-23 amid higher tax revenues.

While this is good news, there is still work to be done to boost tax revenues. India’s tax-to-GDP ratio is 10-11%, well below the average for other emerging economies, where it is 21% of GDP, while the equivalent ratio for the OECD countries is 33%.

Against this background, it can be expected that the forthcoming budget will continue to focus on fiscal consolidation through higher tax revenues. Fiscal consolidation combined with simplification and rationalization may be the overarching themes of this budget.

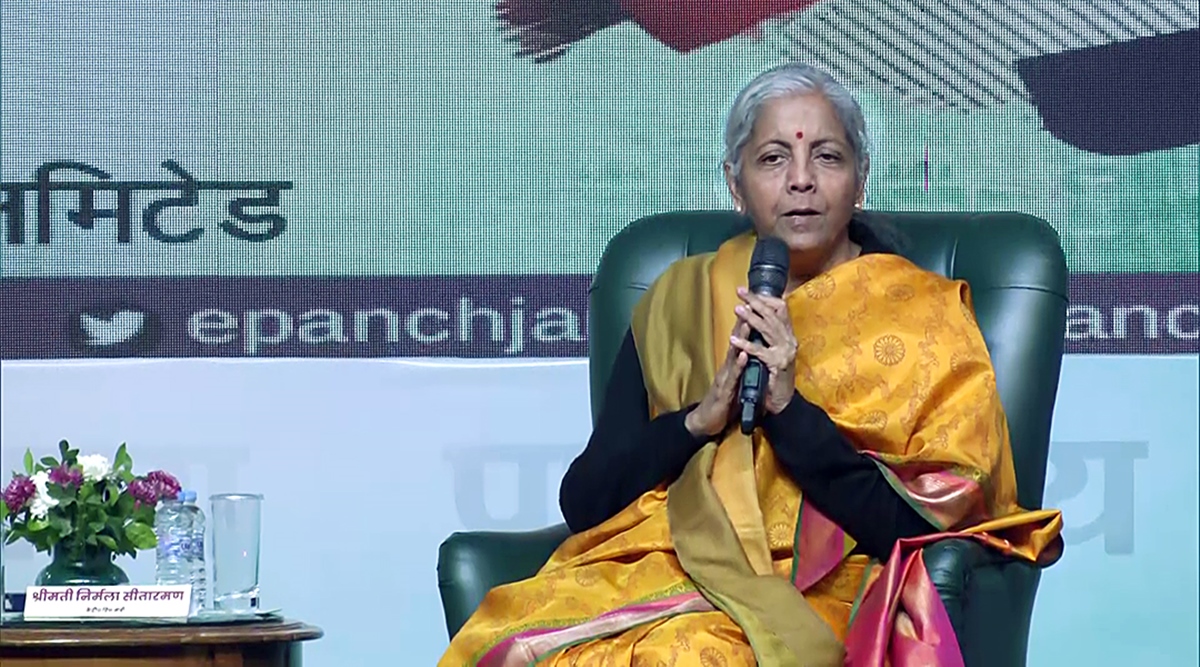

On February 1st Finance Minister Nirmala Sitharaman will present the Union budget for the next financial year (2023-24). With the next general election taking place in early 2024, this budget will likely be the last full budget for the current government. Therefore, the economics of budgeting may need to align with politics as well.

Be that as it may, here are some of the basics of budget planning that one needs to know before presenting the Union budget. Familiarity with the basics of preparing a budget will help readers put the Union budget in perspective.

The 4 things to expect on the economic front in 2023

2022 was a turbulent year in many ways. From the Russian invasion of Ukraine, to the central banks aggressively raising interest rates to combat inflation, to the horrific wave of the pandemic now sweeping through China, the economic fallout from these events has been severe.

Global growth prospects have been steadily downgraded throughout the year. So what are the four things to look forward to next year? How will interest rates develop globally and domestically? What is the outlook for the Indian and global economy? We explain

Inflation is easing, but the big concern this year is growth: here’s why

Official data showed that retail inflation rose 5.7% in December – the fourth consecutive month that retail inflation has weakened. This was seen as a relief as inflation was the biggest economic story of calendar year 2022. Elevated levels of inflation robbed people of their purchasing power and worsened India’s trade deficit, causing the Indian currency to weaken and the RBI to lose significant foreign exchange reserves as it tried to stem the rupee’s slide.

But does that mean inflation has now been tamed? Why is economic growth a bigger concern this year? We answer your questions about inflation and growth

“Incurable gamer. Infuriatingly humble coffee specialist. Professional music advocate.”