Das said a key concern of RBI is that cryptocurrencies have no underlying value. “It’s 100 percent speculative activity,” he added.

Das’s comments come against the backdrop of the global cryptocurrency meltdown that has seen billions of dollars wiped out. India’s central bank refuses to recognize private cryptocurrencies and repeatedly warns against trading them.

Globally, more central banks will embrace digital currencies as they shun private cryptocurrencies, Das said. The Central Bank of India tested its own retail digital currency earlier this month.

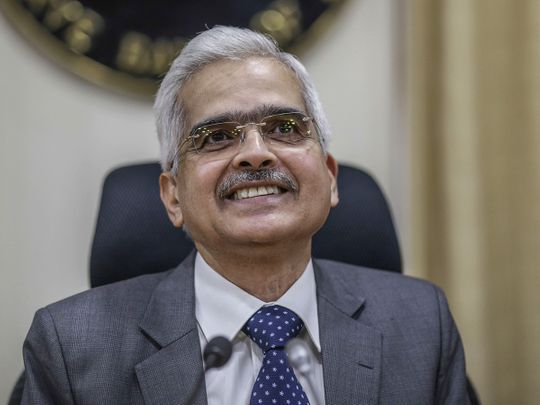

Speaking at the Business Standard BFSI Insight Summit, Das said it was in everyone’s interest to cool high prices in the economy and that the government and central bank were “serious about controlling inflation”. He said monetary policy will not be driven by politics or the upcoming national elections scheduled for 2024. Instead, the RBI “only looks at inflation and growth”.

During the monetary policy review earlier this month, the central bank raised interest rates by 35 basis points, the smallest increase in months. Since May, the RBI has hiked interest rates by 225 points to bring stubbornly high inflation into a target range of 2-6 percent.

“Incurable gamer. Infuriatingly humble coffee specialist. Professional music advocate.”