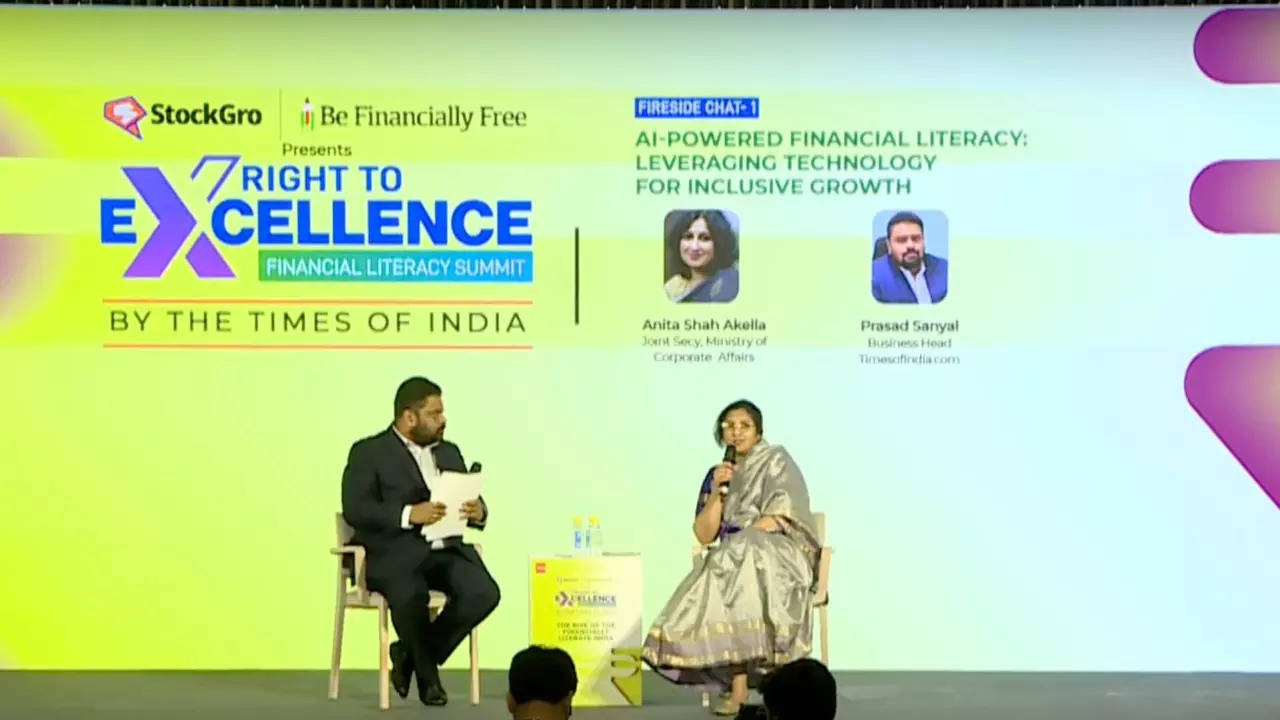

Anita Shah Akella discussed in depth how she believes artificial intelligence (AI) will advance inclusivity in financial literacy. “AI should help me create tailored specific programs. It could be for working women, housewives and underprivileged women,” she said. “For example, we have just started a theme called Niveshak Pehal where we are training the drivers and maids of various RWAs. To inform this initiative that we should aim for, AI will help us,” she said.

Expand

Anita Shah Akella said AI will be used to help people make more informed decisions about where to invest their savings; Educate them about the different investment options available, be it a bank account, stocks, etc.

In the future, AI could be adapted to filter out risky investments or probably also indicate which investment might be safer depending on the risk profile, she says.

She also explained the role of IEPFA and said: “The Investor Education And Protection Fund Authority is an authority established under Section 125 of the Companies Act 2013. If the shares or dividends are not paid for a period of seven years, they will end up in the government's account and the claimant can make a claim on our website by submitting a form. We take confirmation from the company and then return the shares and dividend amount to them,” she said.

IEPFA's other mission is to spread financial literacy. In this direction, the IEPFA has taken several new initiatives; Niveshak Didi, Niveshak Sarathi etc. Nukad Nataks help explain to people how not to be deceived. “If someone offers you something, say I will double your money in two years, so don’t believe them. Check your facts yourself,” she said.

“Incurable gamer. Infuriatingly humble coffee specialist. Professional music advocate.”