CHANDIGARH: About a dozen states crossing party lines on Wednesday have expressed support for extending the mechanism to compensate states for revenue losses caused by the introduction of the GST beyond June 30, but no decision has been made.

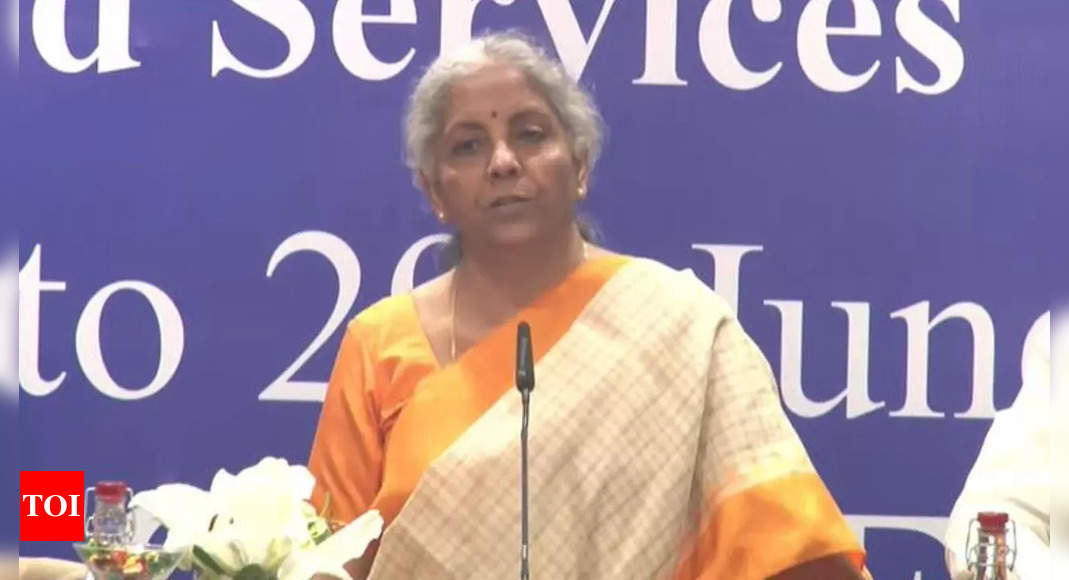

Rapporteur on the deliberations at the two-day meeting of the GST Council here, Union Finance Ministers Nirmala Sitharaman said Treasury and other ministers from 16 states spoke on the compensation issue.

Of the 16 states, 3-4 said they would develop their own revenue stream to break the compensation mechanism, she said.

The Center did not comment on the issue.

At a nationwide VAT (GST) 17 subsumed central and state levies from 1 July 2017, it was decided that states would be compensated for any revenue shortfall from the new tax for five years. This five-year term ends on June 30th.

As the pandemic lost two years, states have sought an extension of this compensation mechanism.

The Council – the highest decision-making body of the indirect tax system, headed by the Union Treasury Minister and made up of representatives from all states and UTs – discussed the issue at a meeting here but made no decision.

FacebookTwitterInstagramKOO APPYOUTUBE

“Incurable gamer. Infuriatingly humble coffee specialist. Professional music advocate.”