With government spending rising above projected levels on the back of a surge in subsidies and the new hiring drive, the center faces renewed challenges to meet its FY23 fiscal deficit target of 6.4 percent of GDP.

While an upward trend in nominal GDP calculations due to high inflation is likely to support the fiscal arithmetic, additional levies in the form of windfall taxes and excise duties, which were expected to potentially boost government revenues later in the year, are now expected to follow , will flow in at a lower than expected level. Though there is the cushion of additional tax revenue, the government faces the prospect of walking a tightrope to manage its tax arithmetic as it simultaneously grapples with additional spending requirements of Rs 2.5-3 lakh crore, officials told The Indian Express . Additional spending includes providing funds for the recently announced recruitment campaign for 10,000 staff and increasing allocations for security and administrative preparations for the G20 summit to be held in India later next year.

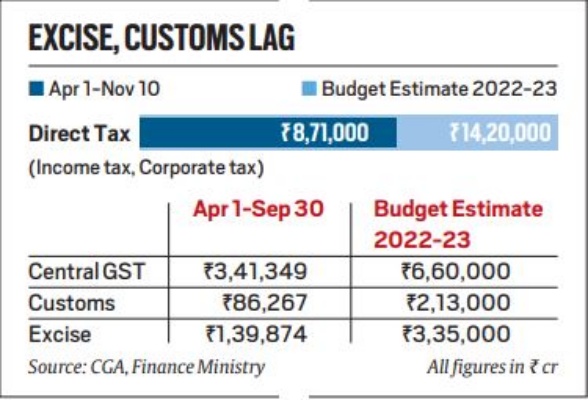

Although overall tax revenues have been boosted by brisk direct taxes and steady Goods and Services Tax (GST) collections, tariffs and excises, as well as other indirect taxes on items outside the GST regime, lag behind, as do windfall taxes Fuel. While windfall taxes are expected to bring in about Rs 30,000-35,000 this fiscal year, revenue from consumption taxes and duties is expected to fall short of the budget target by an estimated Rs 90,000, officials said.

Other revenue streams are also not showing a strong upward trend as divestments are not yet showing their full strength as only 43 per cent of the total budget target of Rs 65,000 crore was raised at Rs 28,382 crore in the first half of this financial year.

However, overall tax revenue is seen as significantly higher with a gain of around Rs 3 lakh crore from GST and direct taxes in the form of income and corporate taxes compared to the budget target. Direct taxes are seen up 25 per cent from the budget estimate of Rs 14.2 billion, Central Board of Direct Taxes (CBDT) Chairman Nitin Gupta said last week. So far as of Nov. 10, net direct tax receipts rose 26 percent year-on-year to Rs.8.71 billion, accounting for 61.3 percent of the total budget estimate for the Inland Revenue. GST revenue accruing to the center in the form of central GST is Rs 3.4 crore, nearly 52 per cent of the budget estimate of Rs 6.6 crore.

“Windfall taxes have not resulted in high revenue as previously estimated, and the numbers will make little difference in all of tax math. There are challenges to spending in the form of subsidies, some of which are met through additional GST and direct tax revenues. Some spending cuts may be necessary and we are considering partial borrowing from small savings,” said a senior government official.

The government had settled Rs.3.18 billion in food, fertilizer and fuel subsidies. Over 2.5 billion rupees are estimated as additional unbudgeted expenses for these subsidies. Earlier this month the union cabinet approved an additional Rs 51,875 crore for nutrient-based fertilizer subsidies. In October, the government agreed to extend the subsidized food grain program by just three months beyond the September deadline amid concerns from the Treasury Department, saying any extension beyond December would increase the fiscal burden.

However, officials claim the government will stick to its budget deficit target of 6.4 percent of GDP for FY23.