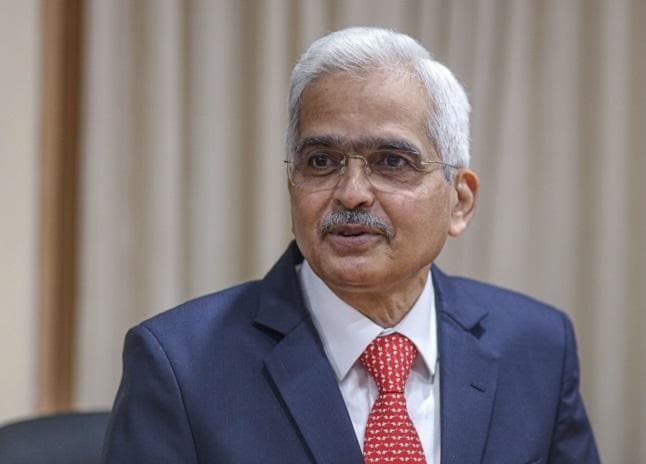

India is expected to be among the fastest-growing major economies despite this fiscal and geopolitical turmoil, RBI Governor Shaktikanta Das said at last month’s MPC rate-setting body meeting, while pledged by a majority to raise the repo rate by 50 basis points. to tame inflation.

On Sept. 30, the six-member Monetary Policy Committee (MPC), headed by Das, raised the interest rate on short-term loans by 50 basis points to 5.9 percent for the third straight month. In May, the repo rate was raised by 40 basis points.

With the exception of Ashima Goyal, who favored a 35 basis point hike, the other five members had voted for a 50 basis point hike in the repo rate.

According to MPC meeting minutes released by the RBI on Friday, Gov. Das had said economic activity was improving steadily, although there were mixed signals.

“While high-frequency indicators show continued momentum in activity, global factors are putting pressure on external demand.

“The 7.0 percent growth forecast for 2022-23 therefore carries risks that are broadly balanced. Regardless of the evolving scenario, India is projected to be among the fastest growing major economies in the world,” the transcript was quoted as saying.

RBI Deputy Governor and MPC member Michael Debabrata Patra had stressed that monetary policy must assume the role of a nominal anchor for the economy as it charts a new growth path.

The focus, he said, should be on matching inflation to the target consistently over time.

“In this context, front-loading monetary policy can keep inflation expectations firmly anchored and balance demand against supply, thereby easing core inflationary pressures,” Patra said.

The RBI, tasked with ensuring retail inflation stays at 4 percent (with a 2 percent margin either side), has failed to meet the target for three straight quarters and is now due to report to the government on the matter.

(Only the headline and image of this report may have been edited by Business Standard contributors; the rest of the content is auto-generated from a syndicated feed.)

“Incurable gamer. Infuriatingly humble coffee specialist. Professional music advocate.”