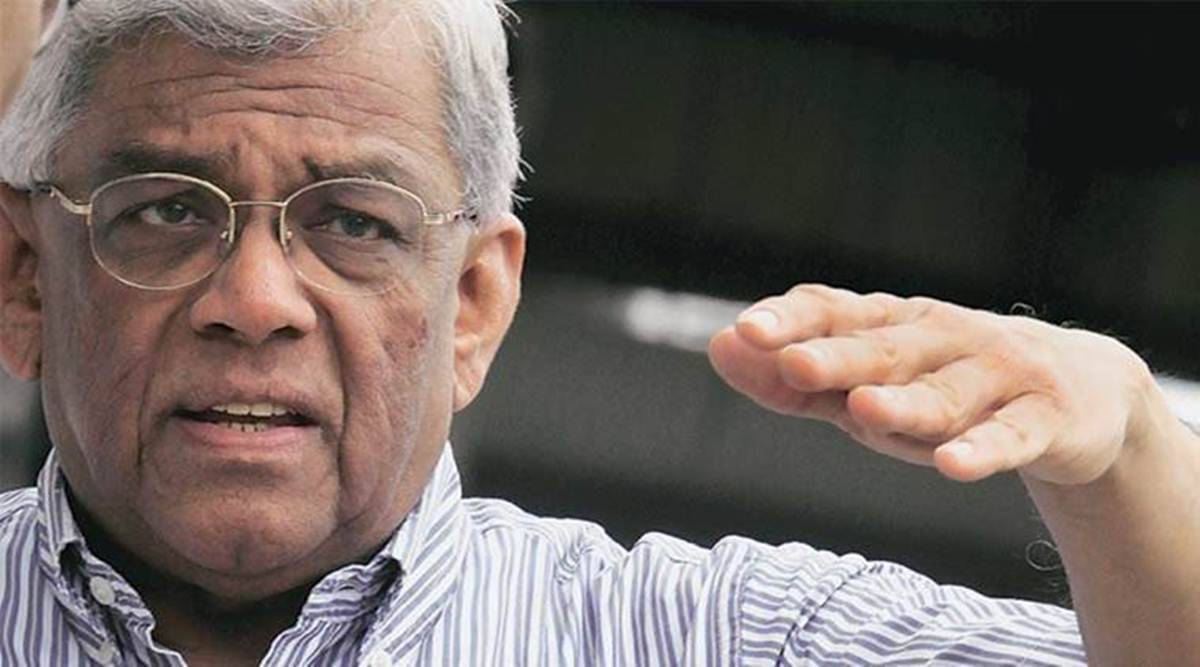

HDFC Chairman Deepak Parekh said on Thursday housing demand is unlikely to be affected by rate hikes in the financial system.

“In fact, current home loan interest rates are still below pre-pandemic levels. Furthermore, a home loan has a long term and during that time there will inevitably be both up and down interest rate cycles,” Parekh said, speaking at HDFC’s annual general meeting.

During the peak of the pandemic, the RBI cut the repo rate by 115 basis points in quick succession, among other liquidity measures to support the economy, he said.

“This position will now be dissolved. It was unrealistic to think that such low interest rates and high levels of excess liquidity would last,” the HDFC chairman said.

The RBI had raised the policy repo rate by 90 basis points to 4.90 percent since May this year in a bid to tame inflation.

While growth expectations have also been dampened in India, India will still be among the fastest growing major economies, with gross domestic product (GDP) growth projected to exceed 7 percent for the current year, Parekh said.

According to Parekh, the mood is a bit gloomy, mainly because of the volatility in the stock markets.

“In India, foreign portfolio investors were risk-averse and sold aggressively, mainly to offset losses made in other emerging markets. Fortunately, in India, domestic institutional investors and increased retail investor participation have helped support equity markets.

“It is also important to recognize that unusual measures have been taken for unusual times during the pandemic and these measures are now being withdrawn in a calibrated manner,” he noted.

While inflation expectations are likely to remain above the RBI’s 6 percent comfort zone over the next three quarters, the rise in inflation rates in India is not due to excessive demand. “India’s current inflation is at its root on the supply side – mainly driven by higher oil and commodity prices, which in turn are compounded by geopolitical tensions. Once supply chain disruptions ease, India’s inflation rate is also likely to moderate,” noted Parekh.

“In terms of home loans, we’ve had an exceptionally good run with strong housing demand coupled with interest rates at all-time lows. In the month of March 2022, HDFC had recorded the highest number of individual loan receipts with over 86,000.

“I continue to argue that despite changes in the macro environment, the growth potential for residential construction in India remains immense,” Parekh said.

“Incurable gamer. Infuriatingly humble coffee specialist. Professional music advocate.”