It has increased the standard allowance for salaried employees by Rs 25,000 from Rs 50,000 to Rs 75,000, while it remained at the same level of Rs 50,000 under the old system. This means that the tax burden for all salary groups will be reduced by Rs 7,500, which with 4% education cess comes to Rs 7,800.

The revised system retains the exemption on income up to Rs 300,000 but adjusts the subsequent tax rates. The 5% rate now applies from Rs 300,000 to Rs 700,000 instead of Rs 600,000 as before. Similarly, the 10% rate comes into effect at Rs 100,000 instead of Rs 900,000. This means that the tax liability on income between Rs 600,000 and Rs 700,000 has come down from 10% to 5%, which is a benefit of Rs 5,000 for taxpayers with income above Rs 700,000.

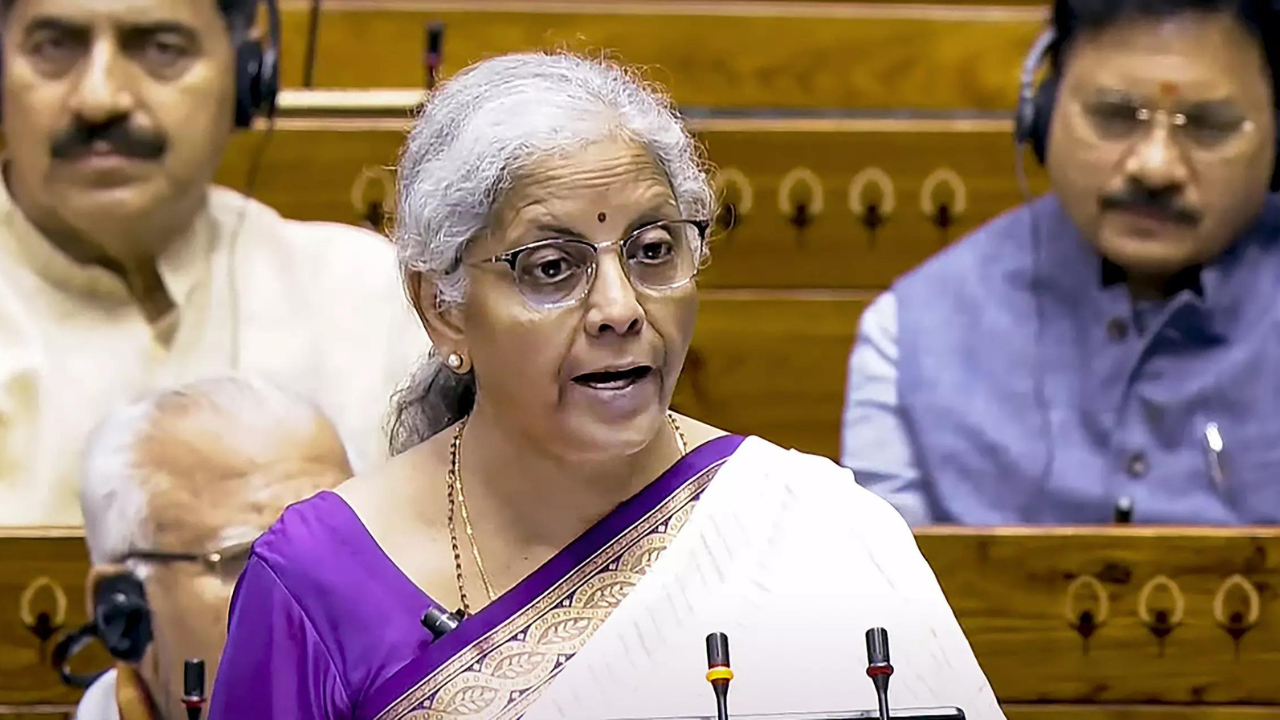

Similarly, it has reduced the tax liability on income between Rs 900,000 and Rs 1 crore by 5% from 15% to 10%, which means an additional saving of Rs 5 lakh. Adding the saving of Rs 7,500 at 30% on income of Rs 1 crore due to the increase in standard deduction by Rs 25 lakh, the total comes to Rs 17,500, the figure mentioned in Sitharaman's budget speech. With the education cess, this amount increases to Rs 18,200.

These increased savings are likely to provide the middle class with more disposable income.

Those who opt for the old tax system (the new system is the default option) will not benefit from these changes. Under the new system, income up to Rs 7 lakh is tax-free. Under the old tax system, only income up to Rs 5 lakh is tax-free.

In this case, under the new tax regime, a taxpayer with an annual income of Rs 1 million will pay a tax of Rs 48,100, including an education cess of Rs 1,850, after taking into account the standard deduction of Rs 75,000.

But in the old tax system, a taxpayer with an income of Rs 10 lakh pays a tax of Rs 1,17,000, including a cess of Rs 4,500. The taxpayer can deduct his investments in tax-saving instruments like equity-oriented mutual funds, pension funds, life insurance and others. Even if one exhausts the investment limit of Rs 1,50,000 under section 80C and considers mortgage interest of Rs 1,50,000, the tax saving is only Rs 60,000 or Rs 62,400, including cess. This still leaves a tax bill of Rs 56,400 under the old system, against Rs 48,100 under the new system.

Take another case where a taxpayer has an income of Rs 1.5 million. Under the new system where no deductions are allowed, the taxpayer pays Rs 1,48,200 including health and education cess of Rs 5,700. Under the old tax system, his tax liability is Rs 2,73,000 including cess of Rs 10,500. After deducting Rs 1.5 million under Section 80 and another Rs 1.5 million as mortgage interest, the tax liability reduces by Rs 93,600 including Rs 3,600 as education cess. He would still have to pay Rs 1,79,400 in tax, more than the tax liability of Rs 1,48,200 under the new tax system.

So when does the old system make sense? If the income is around Rs 930,000 and one invests Rs 300,000 in tax saving schemes, the old system becomes more attractive. In this case, his tax liability under the old system is Rs 40,040, including Rs 1,540 as cess. Under the new system, his tax liability would be Rs 40,820, including Rs 1,570 as cess.

However, to benefit from the old system, one has to invest Rs 300,000 in tax saving schemes. Otherwise, the new system will be better.

“Incurable gamer. Infuriatingly humble coffee specialist. Professional music advocate.”