The bank’s board of directors approved an enabling resolution for the sale of assets in May. The Board’s Credit Committee approved the proposal for a partnership with JC Flowers on July 13. Reserve Bank of India (RBI) guidelines require banks to implement a transparent “Swiss Challenge” process for selling bad loans. Yes Bank has invited other potential buyers to enhance JC Flowers’ offering.

Sources said the distressed assets firm valued Yes Bank’s portfolio at Rs 11,500 crore. She compensates the bank with a combination of cash and securities earnings. The regulations allow the sale for a 15% upfront payment and the balance of 85% in the form of collateral receipts, giving the bank a share of the profits.

Yes Bank had collapsed under the weight of its bad loans in March 2020, resulting in the lender being placed under a moratorium. The government then notified a resolution framework that investors bypassed State Bank of India infused capital to revitalize the bank. The bank had old bad loans of over Rs 51,000 crore which it wanted to sell. There has been some recovery in recent months. As a result, the loans for sale are valued at Rs 48,000 crore.

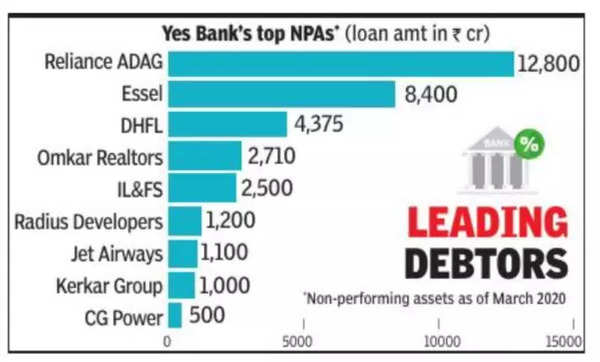

One of Yes Bank’s biggest defaulters is Anil Ambani trust groupEssel Group, Omkar Realtors and Radius Developers (see graphic).

The DHFL has already received repayments from those who defaulted. CG Power has also been fixed. While the Jet Airways solution has been completed, there has been no significant recovery on this account. The IL&FS Board has begun an interim distribution of the recoveries already made.

JCF invests in the financial services sector and leverages regulatory experience in different regions.

In addition to JC Flowers, Ceberus Assets Management competed for partner Yes Bank.